Data centres, cloud sustaining spending now, but future not so certain

Data centres, cloud sustaining spending now, but future not so certain The network security market is being lifted by cloud and data centre projects, but change is on its way, warns a researcher.

Infonetics Research says that global network security appliance and software revenue climbed 6% in 2014, to $6.9bn, as enterprises and network operators deployed security solutions aimed at protecting data and network infrastructure.

Infonetics' fourth quarter 2014 (4Q14) and year-end Network Security Appliances and Software report tracks integrated security appliances, secure routers, SSL VPN gateways, VPN and firewall software, and intrusion detection and prevention products.

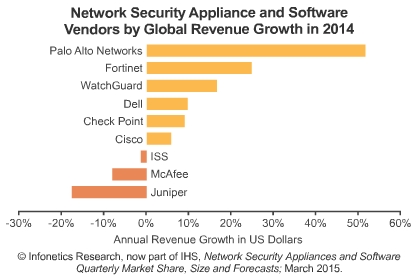

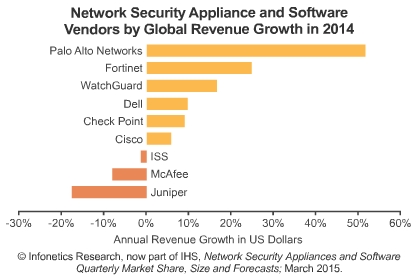

"Closing out 2014 on a positive note with strong performances by most of the top vendors, and especially Palo Alto Networks and Fortinet, the network security space has been on a roll as a result of some very large data centre and cloud projects," said Jeff Wilson, principal analyst for security at Infonetics Research.

"By next year, though, quarterly revenue growth will begin to slow as the industry transitions to lower-ASP virtualised security solutions. But it's not all bad news. Integrated advanced threat prevention security solutions for the Internet of Things (IoT), mobile networks and industrial environments will help support overall market growth," Wilson said.

In the 4th quarter of 2014 (4Q14), the worldwide network security market, including appliances and software, grew 4% sequentially, to $1.9bn. The top 4 network security vendors for the full-year 2014 are, in alphabetical order, Check Point, Cisco, Fortinet and Palo Alto; Juniper slipped out of the top tier, it says.