VMware is stepping up its partner efforts following a year of changes since Broadcom acquired the company.

Partner numbers have been culled, and customers have faced price increases after some products were bundled together, as Broadcom aimed for a simplified product offering, and a partner ecosystem that only contained the most committed to the cause.

Now, VMware says partners have a clear understanding as to what is required, and maintains their go-to-market is more open and the opportunity to grow is wider.

At the annual VMware Explore customer and partner event in Las Vegas, IT Europa sat down with other press and analysts to quiz VMware channel heads about the opportunities.

In a significant move, VMware says it has pulled out of the professional services business itself, and says all pre-sales, deployment and support services are now the responsibility of partners.

IT Europa asked Laura Falko, head of global partner programmes, marketing and experience, what percentage of overall sales professional services generated. While she wouldn’t come up with a ball park figure, she said professional services were “worth a lot of money”, and that they would be worth “much more” going forward.

That’s partly down to the VMware Cloud Foundation (VCF) platform that has been updated and just released as version 9.0, and which now comes bundled with a host of new features, covering security, AI, developer support, data storage, improved networking, and other areas – all designed to support a VMware pitch for on-premise private clouds for operations at customer sites, moving away from public clouds, as we reported yesterday.

Customers need help with all this when it comes to the pre-sales, deployment, and ongoing support stages, and partners will be holding their hands in many cases to make sure their technology deployment blueprints can be validated and supported down the line.

Before dropping its own professional services activity, there were 100 VMware partners in the Expert Advantage segment of the global partner programme covering such services. That number is now set to rise over the next 12 months, said Falko.

We were also told that in the commercial segment of the business, which up to now mainly included SMBs and the mid-market, 25% of new bookings now included VCF, further demonstrating the rising sales importance of that platform. Falko said: “In the commercial bucket, you wouldn’t normally see smaller organisations around VCF, but we’re now seeing larger mid-market firms get involved and some SMBs, and this will continue.”

Falko added: “We are moving from a transactional ecosystem to a value-based one, so we want partners to start early with customers, to glean intelligence and help them take full advantage of the new features we are offering, around Kubernetes or AI, for instance.”

Technology silos at customer sites were sometimes a problem, she said. “We want partners to help customers remove those silos so they can take full advantage of what VCF can offer. But we have to be sensitive around this, as removing silos could impact jobs at customer sites.”

Customer renewals are now the key target for VMware, with the aim of upscaling existing deployments using the new features. “Ours is a renewals partner programme, there aren’t many new customers to go after in our space, so to renew is the key aim of partners,” said Falko.

VMware has also set up a partner advisory board that meets every six months, and the firm has also started regional partner activation events, with one in Amsterdam having already taken place, and with one in Paris soon to happen.

On the possibility of partner numbers going back up as a result of the product offer evolving, Falko said: “It’s the quality of our ecosystem that counts. I don’t really care if the number is higher or lower in 12 month’s time, although I’m sure there will be new ones coming in.”

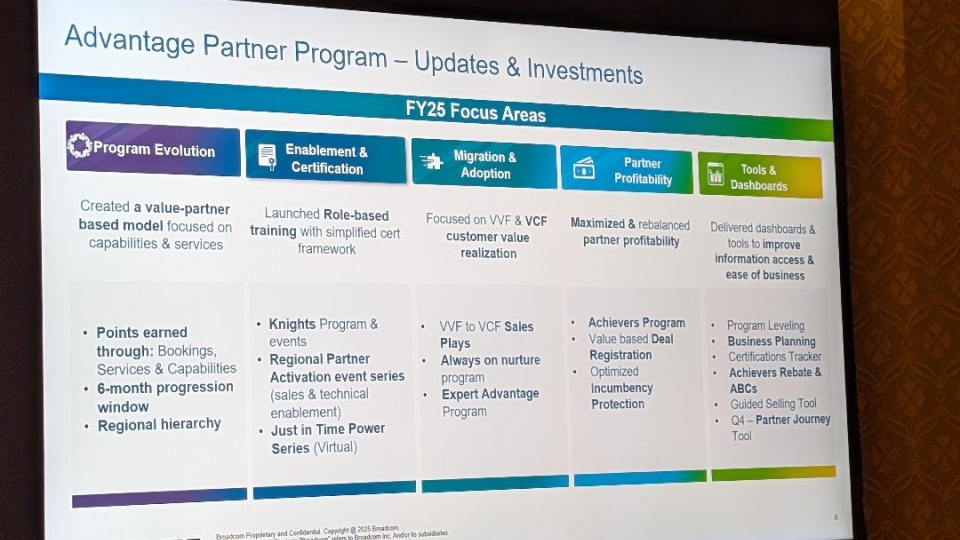

Picture: The slide above is what VMware describes as its “partner progress”, following the acquisition, up to now.

More to follow from VMware Explore in Las Vegas...