US cloud content management vendor Reveille Software is searching for more European partners after launching its first global partner programme, which will make the vendor a “channel-only” operation.

Reveille says it currently provides enterprise content management (ECM) and enterprise information management (EIM) solutions to over 200 Fortune 500 companies, including six of the top ten financial institutions and seven of the top 20 pharmaceutical companies.

It is looking to sign-up resellers, distributors and technology partners in North America and Europe, and anticipates extending the partner programme to other geographic regions in the near future.Its technology will now only be sold via its approved channel partners, “eliminating any potential conflict over pricing” and “ensuring they have the dedicated resources at their disposal to succeed in the market”, it said.

“With millions of employees working remotely and logging in to their corporate networks from home due to the Covid-19 pandemic, businesses are under increasing pressure to bring greater control and visibility across their ECM and EIM systems,” said Reveille.

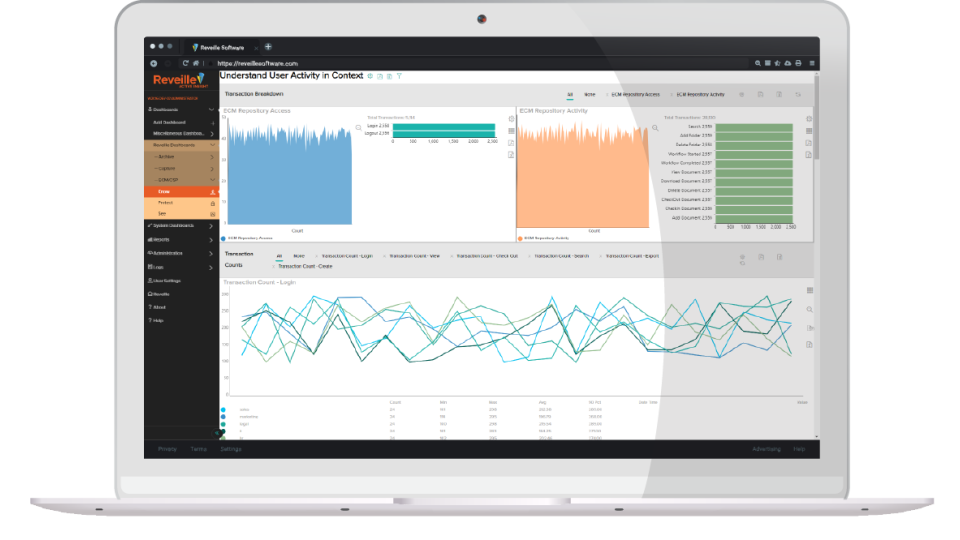

The firm's agentless technology enables organisations to “see, know and protect” content via real-time user dashboards and reporting. The company's technology is integrated with content services platforms from the likes of Microsoft, OpenText, IBM, Box and Kofax.

“We built this new channel programme to make it as simple and streamlined as possible for partners to sell our solution with confidence and accelerate their path to profitability,” said Rick Butgereit, CMO for Reveille. “We have significantly boosted our investment in our partner ecosystem to drive broad global adoption and leverage the unique systems integration capabilities of our partners to drive customer satisfaction.

“We are confident that this new programme will make it even easier for partners across the spectrum to add value to their portfolio offerings.”