Year of reorganisation hits HPE, as other vendors also shrink

Market leader HPE saw its market share tumble year-on-year on top of a shrinking of total sales in the first quarter of 2017 as IDC reported on the EMEA server market. It reported a year-on-year decline in vendor revenues of 12.7% to $2.7bn and a YoY decrease of 1.4% in units shipped to just over 530,000. Looking at the EMEA market in euros, reported revenues in 1Q17 declined 9.6% YoY. The top 5 vendors in EMEA and their revenues for the quarter are displayed in the table below.

Top five EMEA Vendor Revenues ($M)

|

Vendor |

1Q16 Server Revenue |

1Q16 Market Share |

1Q17 Server Revenue |

1Q17 Market Share |

1Q16/1Q17 Revenue Growth |

|

HPE |

1,123.7 |

37.0% |

907.0 |

34.2% |

-19.3% |

|

Dell EMC |

536.1 |

17.7% |

562.4 |

21.2% |

4.9% |

|

Cisco |

211.6 |

7.0% |

198.5 |

7.5% |

-6.2% |

|

Lenovo |

196.8 |

6.5% |

183.4 |

6.9% |

-6.8% |

|

ODM Direct |

89.5 |

2.9% |

154.3 |

5.8% |

72.5% |

|

Others |

879.0 |

28.9% |

646.8 |

24.4% |

-26.4% |

|

Total |

3,036.7 |

100.0% |

2,652.3 |

100.0% |

-12.7% |

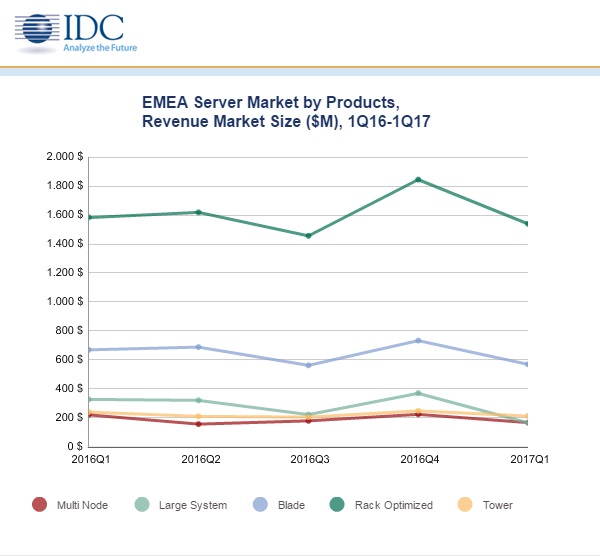

When viewing the EMEA market by product, the biggest decline was seen in standard multinode shipments, which declined 46.6% yr/yr. Custom multinode servers were a standout performer with 101.1% YoY shipment growth, along with custom rack optimized at 48.6%.

"The ODM market was the notable outperformer over the quarter, with revenue growth of 72.5% to reach 5.8% of market share in EMEA. Strong ODM growth is representative of the continued attraction of lower ASPs and greater flexibility in hardware customization," said Eckhardt Fischer, senior research analyst, European Infrastructure, IDC.

In terms of vendors, HPE remained at the top of the Western European server market with 34.0% market share, though revenues for the firm fell 21.4% YoY. Dell was the only major vendor to see 1Q17 growth in Western Europe, reaching 21.4% market share.

"Server revenues in Western Europe continued to decline in 1Q17. In particular, IBM server revenues decreased 50.3% due to declining non-x86 shipments and a continuing trend for extended refresh cycles," said Michael Ceroici, research analyst, European Infrastructure, IDC.

From 1Q16 to 1Q17, the only Western European countries with positive revenue growth were Ireland at 0.2% and Norway at 1.1%. Server markets in France, the Netherlands, and Switzerland saw the poorest performance over the quarter, with revenue declines of more than 20%.

"Central and Eastern Europe, the Middle East, and Africa (CEMA) server revenue continued its negative, trend posting a decline of 6.3% YoY to $523.73m in 1Q17. The Central and Eastern Europe (CEE) subregion grew 7.2% YoY with revenue of $231.14m and was the only region in EMEA recording growth," said Jiri Helebrand, research manager, IDC CEMA.

"Economic stabilisation in countries such as Russia, Ukraine, and Kazakhstan, as well as large ODM deals in Russia contributed to growing HW sales in first quarter of year 2017.

IDC Server form factors have been amended to include the new "modular" category that encompasses today's blade servers and density-optimized servers (which are being renamed multinode servers). As the differentiation between these two types of server continues to become blurred, IDC is moving forward with the "modular server" category as it better reflects the directions in which vendors and the entire market are moving when it comes to server design. Modular platforms that do not meet IDC's definition of a blade are classified as multinode. This was formerly called density optimized in IDC's server research and server-related tracker products.