Focusing on shaving a few pounds off hardware costs overlooks more pressing strategic requirements as falling margins, slowing upgrades and new service models reshape priorities.

For years, networking has been one of the most dependable revenue streams for IT providers. Regular refresh cycles, predictable speed-driven upgrades and reliable margins on switches and access points made it a core pillar of many business models. That formula is now under strain. Hardware margins are falling, traditional managed firewall offerings are losing relevance, and SMB refresh cycles are slowing. To protect profitability, MSPs need to shift their focus toward services, security and compliance.

Hardware margins under pressure

Networking equipment has become increasingly commoditised. According to IDC, average margins on networking hardware have fallen by more than 20% over the past five years, with many SMB-focused partners now seeing single-digit returns. Price competition between vendors, combined with supply chain normalisation post-pandemic, has made it difficult to maintain healthy margins on switches, routers and access points.

In the SMB segment, most vendors now offer broadly similar performance across their portfolios. A mid-range model today often matches or exceeds the throughput of premium devices from just a few years ago. This makes it difficult for partners to differentiate based on raw hardware specifications alone.

Traditional managed firewall services, once a progressive element of of SMB security, are increasingly out of step with modern threats. Static perimeter defences cannot keep pace with distributed workforces, cloud applications and constantly shifting attack vectors.

Managed Detection and Response (MDR) has emerged as the preferred model for many mid-market and enterprise organisations. Gartner estimates that global spending on MDR will grow at more than 20% annually through 2027. However, the cost and operational complexity of enterprise MDR makes it unsuitable for many SMBs, creating a gap that traditional firewall services no longer fill effectively.

Build SMB-friendly managed security stacks

For smaller MSPs, this gap represents an opportunity. By assembling their own managed security stack from service-friendly point solutions, they can deliver strong protection without enterprise-level pricing. Combining tools such as endpoint detection and response, DNS filtering, email security, vulnerability scanning and threat intelligence can provide layered protection that is manageable and affordable.

Crucially, the commercial focus should shift away from relying on profit from hardware and licences, and toward building high-margin managed services. Packaging these modular security layers into a single monthly managed security service allows MSPs to retain pricing control and strengthen client relationships.

The number of networking vendors active in the SMB space has remained remarkably stable over the past decade. While market leaders may have shifted, the overall competitive field has not narrowed. Technical differences between core products are increasingly marginal.

Where MSPs can find real differentiation is in integration capabilities, automation tools and ease of doing business. Vendors offering multi-tenant dashboards, open APIs, flexible licensing and straightforward monthly billing are becoming more attractive than those focused solely on hardware performance. In a market where the technology is largely comparable, operational efficiency and partner enablement are decisive factors.

SMB network refresh cycles are lengthening

Historically, SMBs upgraded core network infrastructure at major speed inflection points: 10 Mbps, 100 Mbps, 1 Gbps and more recently 10 Gbps. Each leap delivered clear performance gains that justified significant investment.

Today, however, most SMB networks already provide more bandwidth than is required for typical workloads. This means the traditional four-to-five-year refresh cycle is extending. Dell’Oro Group research indicates that SMB switching lifecycles have lengthened by up to 30% since 2018, with many organisations now keeping infrastructure in place for seven years or more.

As refresh cycles slow, large one-off CAPEX projects become less frequent, making it essential for MSPs to find new ways to generate consistent revenue between upgrades.

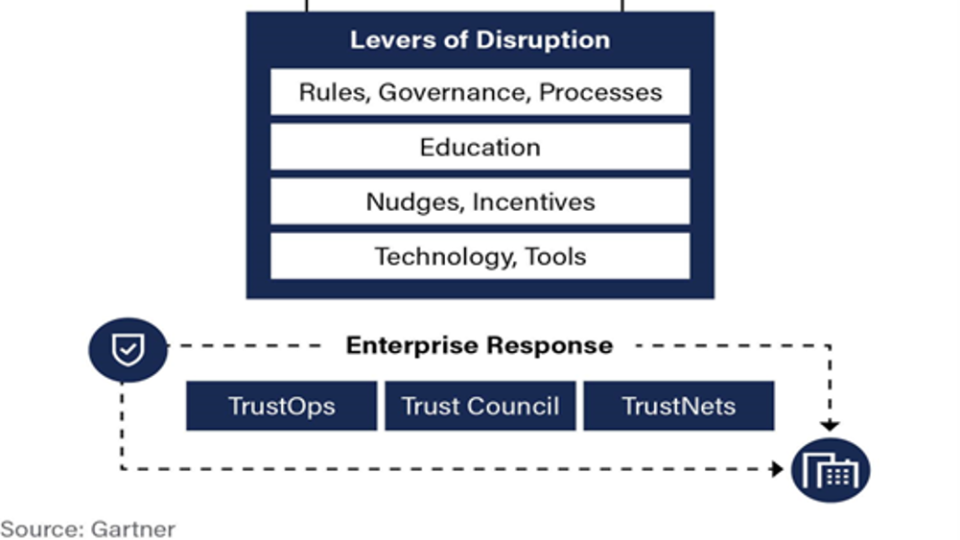

For MSPs with significant networking revenues, the most strategic response is to embrace compliance-driven service models and adapt MDR-style offerings for the SMB market.

Regulatory initiatives such as NIS2 and GDPR are increasing pressure on businesses to maintain secure, resilient networks. Rather than treating compliance as an afterthought, MSPs can embed it into ongoing service contracts. Regular audits, performance monitoring, documentation and proactive remediation can all be wrapped into predictable monthly services.

At the same time, MSPs can adapt MDR principles to suit SMB budgets by combining modular security tools with their networking expertise. Continuous monitoring, alert triage and rapid incident response can be delivered without the cost structure of full enterprise MDR. This positions MSPs as trusted advisors, not just hardware suppliers.

And finally....

Networking will remain a core part of MSP portfolios, but its economic foundations are shifting. Hardware refreshes will still happen, but less frequently and with lower margins. The growth opportunity now lies in delivering security, compliance and performance as ongoing services. Partners that evolve their models toward monthly recurring revenue based on trust and expertise will be best placed to thrive as the traditional network sales cycle slows.

No matter which vendor you choose — whether it’s Cisco, Netgear, D-Link or anyone else — focusing solely on speeds, feeds and finding the cheapest piece of tin is short sighted. The real questions to ask are how open the platform is, how well it integrates with other tools, whether there is a hidden subscription tax to unlock essential features, and what kind of relationship the vendor has with the channel. These are not always easy questions, but they are critical for long-term success.