MSP systems supplier N-able is stepping up its assault on the growing data backup market by taking shots at the more dominant players in the space.

At last week’s N-able Empower partners conference in Las Vegas, which IT Europa attended, company CEO John Pagliuca described N-able’s Cove data backup offering as something of a Cinderella product, often being offered to MSPs behind the firm’s more established remote, monitoring and management (RMM) portfolio, and its security protection package built on SentinelOne technology.

Pagliuca claimed however, that when MSPs used the firm’s Cove Data Protection system, they often wondered why they hadn’t done so earlier. Which was one reason why Empower was used to promote performance and feature updates to the Cove offering.

Now, the company has used this week’s IT Press Tour across Silicon Valley, which IT Europa is also attending, to go on the offensive against backup heavyweights including Veeam, Datto and Acronis.

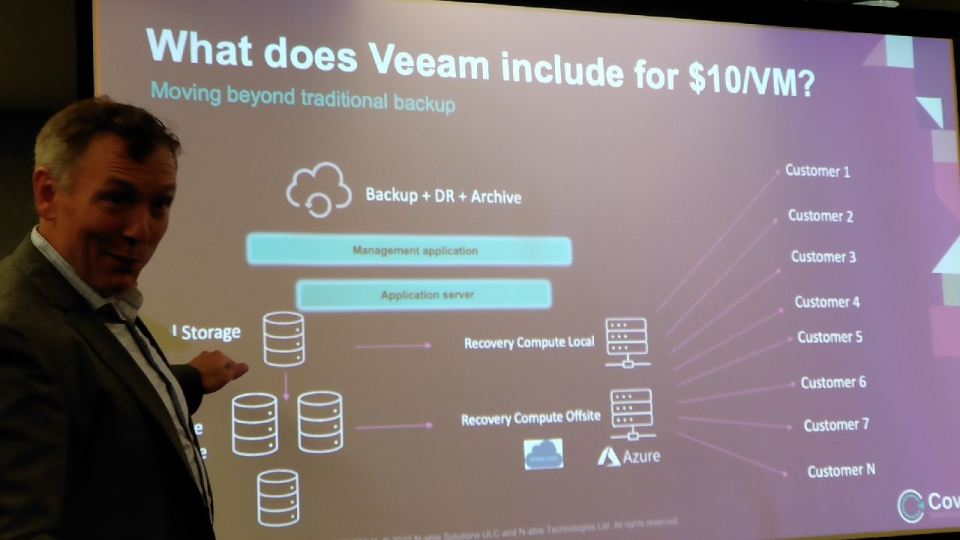

Chris Groot (pictured), general manager for N-able’s data protection business unit, told Tour attendees: “Appliance-free Cove is a cloud-first platform that is supported by 30 data centres globally, and which now protects 145,000 businesses served by our MSPs. And it’s easier to tackle ransomware with Cove than with Veeam.”

He claimed: “When ransomware gets into the system, the target is usually to get at your backup, but our backup is not on the network, it is in the cloud. It’s better off being off-premise, unlike the way Veeam is usually deployed on-premise by their providers.”

He added that Cove came with an extra layer of security in the cloud too, if attackers chose to launch attacks there on backups, which does occasionally happen.

Groot said the much larger Veeam was N-able’s largest rival globally, with Datto being its main competitor in North America, and Acronis also being a big competitor internationally to its SME and mid-scale backup platform. Veeam has annual sales of over $1bn, Datto is now owned by N-able’s main rival Kaseya – which is bigger than N-able - and Acronis doesn’t publicly reveal its annual sales. For it’s part, N-able’s total annual sales for all products is around $360m, with the RMM segment still the biggest bread winner for the company.

While Veeam and Acronis data-protection is software-based, Groot said Datto was “expensive” as its offering was appliance-based. Groot said: “Datto doesn’t want to be expensive, it’s just the way it does backup.”

He claimed the running costs of Cove were four-times cheaper than a Datto data backup system, and described both Veeam and Datto as “icebergs” with extra costs above or below the surface, compared to Cove’s perfectly formed cloud-first “ice cube”, when it came to deployment and running costs.

He further claimed that compared to Veeam and Datto, the total cost of ownership (TCO) of a Cove system was “50% cheaper”.

As with any product comparison, the needs of MSPs and their end-customers will vary, and many may well need some of the features and performance parameters offered by Veeam and Datto, but not N-able, of course. Even Groot admitted that Cove may not be the fastest disaster recovery offering on the market, for instance.

What is clear however, is that N-able is no longer hiding Cinders - Cove wants to go to the increasingly busy data backup ball.