Europe is expected to lead the way for telco spending in the next few years. Market research firm Infonetics Research released excerpts from its latest Global Telecom and Datacom Market Trends and Drivers report, which analyses global and regional market trends and conditions.

Europe is expected to lead the way for telco spending in the next few years. Market research firm Infonetics Research released excerpts from its latest Global Telecom and Datacom Market Trends and Drivers report, which analyses global and regional market trends and conditions.  Europe is expected to lead the way for telco spending in the next few years.

Europe is expected to lead the way for telco spending in the next few years.

Market research firm Infonetics Research released excerpts from its latest Global Telecom and Datacom Market Trends and Drivers report, which analyses global and regional market trends and conditions. Software-defined networks (SDNs) and network functions virtualisation (NFV) have the attention of nearly all service providers, who are on the long road to widespread deployments, it says.

"Expect a slowdown in the Americas, but for a change, Europe will be in the telecom capex driver's seat this year!" says Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research. "We're forecasting global carrier capex to rise 4%, with EMEA as the growth engine despite unabated low-single-digit revenue declines all across Europe. After waiting for so many years to upgrade their networks, Europe's 'Big 5'-Deutsche Telekom, Orange, Telecom Italia, Telefónica, and Vodafone-have decided it's time to take the plunge."

Co-author of the report Matthias Machowinski, Infonetics' directing analyst for enterprise networks, adds: "Economic expansion in mature economies and falling unemployment in Europe is driving stronger growth in enterprise telecom and datacom expenditures this year. We expect the network infrastructure segment to be the main beneficiary of growing investments, followed by security. The communication segment will likely have another challenging year, as companies evaluate their deployment strategy going forward."

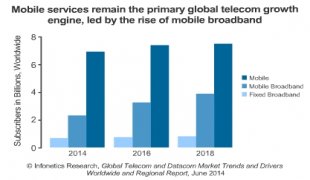

Mobile service revenue remains the main telecom/datacom growth engine worldwide, led by the unabated rise of mobile broadband. And, to avoid falling into the role of pipe provider, many service providers are deploying or weighing new architectural options such as caching/content delivery networks, next-gen central offices, distributed mini data centres, and video optimisation

The IMF thinks the world economy will expand 3.6% in 2014 (+0.06 from 2013) amid recoveries in the UK and Germany and slowing growth in Japan, Russia, Brazil, and South Africa. Among the technologies, Big data is becoming more manageable: Operators are leveraging subscriber and network intelligence to support marketing and loyalty strategies, churn management, and automation/optimization of networks using SDN and NFV.