Utilities will keep spending on IT in Western Europe, with software rising fastest. According to a new IT spending forecast report published by IDC Energy Insights, total year-end IT spending by Western European utilities is expected to reach $13.5bn by 2018, with an estimated 2013–2018 CAGR of 4.1%.

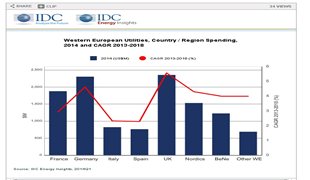

Utilities will keep spending on IT in Western Europe, with software rising fastest. According to a new IT spending forecast report published by IDC Energy Insights, total year-end IT spending by Western European utilities is expected to reach $13.5bn by 2018, with an estimated 2013–2018 CAGR of 4.1%.  Utilities will keep spending on IT in Western Europe, with software rising fastest. According to a new IT spending forecast report published by IDC Energy Insights, total year-end IT spending by Western European utilities is expected to reach $13.5bn by 2018, with an estimated 2013–2018 CAGR of 4.1%. Analyzing current IT spending, total year-end IT spending by Western European utilities is expected to be $11.6bn in 2014, with electricity companies accounting for the largest share of spending, at 67% or $7.7bn of the total.

Utilities will keep spending on IT in Western Europe, with software rising fastest. According to a new IT spending forecast report published by IDC Energy Insights, total year-end IT spending by Western European utilities is expected to reach $13.5bn by 2018, with an estimated 2013–2018 CAGR of 4.1%. Analyzing current IT spending, total year-end IT spending by Western European utilities is expected to be $11.6bn in 2014, with electricity companies accounting for the largest share of spending, at 67% or $7.7bn of the total.

"Despite the economic downturn, utilities are investing in IT to achieve operational efficiency and possibly innovate and grow," said Gaia Gallotti, research manager, IDC Energy Insights. "Software spending will see the most significant increase, growing at a 2013–2018 CAGR of 6.3%, reaching $3.6bn by 2018. IT services also has a positive outlook, growing just below average at 3.8%, while hardware spending, when excluding mobile devices, is expected to be almost flat, barely growing at 1.4% between 2013 and 2018."

The report, which includes market sizing and forecast estimates for the utilities industry in Western Europe for 2013–2018, shows that:

- Electricity already accounts for the largest share of IT spending in 2014. The subindustry is not expected to reduce its spending any time soon as it will have the fastest-growing, above-average CAGR between 2013 and 2018 (4.6%).

- Gas is also expected to continue to spend well in the forecast period, but spending will be below average at a 2013–2018 CAGR of 3.7%.

- The water subindustry will have the slowest growth rate — significantly below average at 2.7% — though this is expected as companies in this subindustry are often smaller and more localized, making it more difficult for them to find financial resources to invest in IT, especially with the current economic situation (with the U.K. being the exception).

- The UK has the largest IT spending in the electricity sector, accounting for 20.5% of total electricity IT spending in Western Europe.