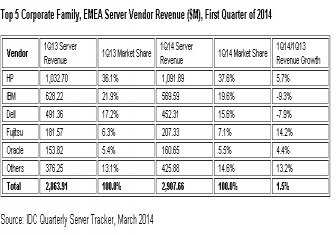

There were fewer servers in EMEA in Q1 this year than last year, but the price was higher. HP remains top dog, with IBM and Dell falling back. It confirms the picture of a highly competitive market painted last week by Gartner.

Vendor revenue in the EMEA server market hit $2.9bn in 1Q14, $44m more than in 2013 (+1.5% yr/yr), says IDC. According to the tracker, 537,800 units were shipped in 1Q14 -3.9% fewer than in 1Q13. IDC puts this down to due to the rise in virtualization and integrated systems.

Vendor revenue in the EMEA server market hit $2.9bn in 1Q14, $44m more than in 2013 (+1.5% yr/yr), says IDC. According to the tracker, 537,800 units were shipped in 1Q14 -3.9% fewer than in 1Q13. IDC puts this down to due to the rise in virtualization and integrated systems.

The quarter-on-quarter performance in the EMEA region between 4Q13 and 1Q14 highlighted an overall negative trend, with a 20.3% decrease in vendor revenue and a 10.8% decrease in units shipped. The strong disparity between the corresponding quarters and quarter-on-quarter figures can be attributed to the very seasonal nature of the server market in EMEA, where many deals take place at the end of the calendar year.

"Units shipped in EMEA over the past three years have continued along the same consistent contraction trend, with 3Q11 the last quarter to see clearly positive unit growth in the region," said Giorgio Nebuloni, research manager, Enterprise Server Group, IDC EMEA. "Despite a strong push for additional capacity in megadatacenter customers and renewed focus on tower and rack volumes by the largest OEMs, the macro-trend in the x86 market continues to point to value as the only real growth opportunity. Vendors with a strong focus on attach rates and profitability are the best positioned to win in this market."

The increase in vendor revenue between 1Q13 and 1Q14 can be attributed to the positive growth in EMEA's two largest product types, with rack-optimized and blade servers seeing 2.8% and 5.0% growth in revenue respectively. These two products contributed 76.1% to overall EMEA vendor revenue and saw a combined 3.4% increase compared with 1Q13, though their unit shipments continued to decrease. This has resulted in an increase in ASPs for rack-optimized and blade servers — an increase of around $357, according to IDC's quarterly tracker.

"The EMEA blade market has seen strong growth in the higher-end market," said Eckhardt Fischer, research analyst, IDC EMEA Enterprise Server Group. "This targeting of higher-end blade systems is allowing vendors to offset the drop in units shipped with higher average selling prices. This has made it possible for vendors in the EMEA market to generate positive dollar revenue growth despite a decrease in units. Blade servers have also seen increased traction in integrated systems and datacenters-in-a-box, a segment that over the past year has seen strong double-digit growth in the region. We expect this to remain a constant in 2014, as blades become part of broader integrated solutions."

x86 server market revenue for 1Q14 totaled $1.72bn, and accounted for 81% of the total value (an increase of 6 points on the previous quarter and equal to that of 1Q13). x86 servers in EMEA grew 2.2% in dollar revenue terms, despite the continued decline in units shipped (down 3.7%).

Non-x86 vendor revenue accounted for $541m and 3,810 units in the EMEA region, a decline of 1.3% and 27.2% respectively compared with 1Q13. Quarter-on-quarter non-x86 servers declined 39% in revenue and contracted by 2,368 units (down 38.3%).

"All Western European markets bounced back to growth this quarter, except Ireland, France, and Spain, which experienced double-digit declines in vendor revenues," said Andreas Olah, research analyst, Enterprise Server Group, IDC EMEA. "The Irish market is severely impacted by the slowdown in megadatacenter expansion by cloud providers there that are expected to focus more on building new facilities in Continental Europe within the next year in order to serve major markets from local datacenters. Government spending remains an inhibitor for growth in France and Spain, while investments continue to pick up in Germany and the UK.

"Most notably, the Italian server market grew 33.9% year on year, mainly down to a large legacy systems project this quarter. At the same time a moderate decline was experienced on the x86 side there, which is still affected by the current climate of economic and political uncertainty. In contrast, the Dutch x86 market picked up substantially by 25.7% due to a combination of improving economic conditions, a well-established hosting community, and investments by cloud service providers."

Central and Eastern Europe, the Middle East, and Africa (CEMA) server revenue continued to decline, decreasing 2.8% year over year to $673.72m in 1Q14. Sales of x86 servers recorded a marginal increase, driven by demand for blade and rack-optimized servers, while non-x86 servers continued in negative trend.

"The Central and Eastern Europe [CEE] subregion was down 5.7% to $335.70 million," said Jiri Helebrand, research manager, IDC CEMA. "Investments in datacenter expansion from Internet and cloud service providers drove demand for x86 rack servers, keeping overall x86 server revenue afloat. In contrast, non-x86 server revenue declined 29.7% year over year.

Windows had 56.1% revenue share, generating vendor revenue in 1Q14 of $1.6bn, up 1.9% on 1Q13. Second spot was taken by Linux operating systems with 24.3% of the market and vendor revenue of $707m.